Resources for your Business During Coronavirus COVID-19

冠狀病毒COVID-19期間為您的企業提供的資源

Free, bilingual “Vaccine Card Reminders” for businesses to print and display on their doors:

Dear Business Owner:

We created this packet of information regarding the City’s COVID-19 vaccine card requirement for you. This packet includes a couple of notices that you can post to your business entrance.

I encourage you to sign up for PCDC’s Commercial Corridor newsletter and add PCDC on WeChat, where we share upcoming PCDC events and programs including small business assistance/resources.

We know that operating your business is very difficult. Hopefully, this packet will make it a little easier for you to inform your customers and train your staff about the City requirements.

Sincerely,

Bill Sze

NAC Program Coordinator

Philadelphia Chinatown Development Corporation

Click to download English

尊敬的業主:

我們為您創建了一套有關本市 COVID-19 疫苗卡要求的相關信息的文檔。此文檔包含一些通知,您可以將其張貼到您的企業入口處。

我鼓勵您註冊費城華埠發展會(PCDC)的商業走廊簡報,並在微信上添加 PCDC,我們將在微信上分享即將舉行的 PCDC的活動和計劃,包括小型企業的援助/資助。

我們了解在疫情期間經營您的企業非常的困難。希望此文檔能讓您更輕鬆地通知客戶並培訓您的員工了解本市的疫苗要求。

謹啟:

施偉廉

社區規劃與項目助理

費城華埠發展會

Click to download 中文

**The info found on this page is up to date as of January 14, 2022.

**此网页最后更新于2022年1月 14日。

Other Resources

GOVERNMENTAL POLICIES

According to the City of Philadelphia, starting January 3, 2022, any establishment in Philadelphia that sells food and/or drink for consumption onsite may admit only those patrons who have completed their vaccine series against COVID-19.

- From January 3 through 17, establishments may choose to accept proof of a negative COVID-19 test within 24 hours of entry in lieu of proof of vaccination.

- After January 17, negative COVID-19 tests can no longer be accepted in lieu of proof of vaccination.

- Staff and children aged five years and three months through 11 will be required to have had one dose of COVID-19 vaccine by January 3 and to complete their vaccine series by February 3.

Staff and children can receive their first dose at PCDC’s free, walk-in COVID-19 vaccination site every Wednesday from 2PM – 5:30PM in Chinatown (1001 Vine Street).

Certain people who cannot be vaccinated are exempted from this requirement:

- Children under five years and three months of age

- People with signed medical exemptions from a licensed practitioner

- People with religious exemptions, who have attested in writing that they have a sincerely held religious belief that prevents them from being vaccinated

Anyone who is exempted will be required to show proof of a negative COVID-19 test within 24 hours of entry into an establishment that seats 1,000 or more people. This requirement does not apply to children under age two, who cannot be tested easily for COVID-19.

This vaccine mandate applies to places like:

- Indoor restaurant spaces

- Cafes within larger spaces (e.g., museum cafes)

- Bars

- Sports venues that serve food or drink for onsite consumption

- Movie theaters

- Bowling alleys

- Other entertainment venues that serve food or drink for onsite consumption

- Conventions (if food is being served)

- Catering halls

- Casinos where food and drink is allowed on the floor

- Food court seating areas should be cordoned off and have someone checking vaccine status on entry to the seating area

This vaccine mandate does not apply in places like:

- K-12 and early childcare settings

- Hospitals

- Congregate care facilities or other residential or healthcare facilities

- Outdoor restaurant spaces

- Grocery stores, except in seated dining areas within those stores, convenience stores or other establishments that primarily sell food and other articles for offsite use

- Philadelphia International Airport, except in traditional seated restaurant or seated bar style locations

- Soup kitchens or other sites serving vulnerable populations (e.g., Hub of Hope)

- This mandate excludes masked individuals who are entering an indoor establishment for a short duration or transitory purpose (e.g., less than 15 minutes, picking up food, using the bathroom)

- Food establishments who are not in compliance with this vaccine mandate or the indoor mask mandate can be reported by calling 311.

政府政策

根據費城市政府的規定,從2022年1月3日開始,費城任何在現場銷售食品和/或飲料的場所只能接納那些已經完成COVID-19系列疫苗接種的顧客。

- 從 1 月 3 日到 17 日,各企業可以選擇在進入後 24 小時內接受 COVID-19 測試陰性的證明來代替疫苗接種證明。

- 1月17日之後,不再接受COVID-19的陰性檢測來代替疫苗接種證明。

- 5歲零3個月至11歲的兒童和工作人員將被要求在1月3日前接種一劑COVID-19疫苗,並在2月3日前完成疫苗接種。

工作人員和兒童可以在每週三下午2點至5點30分在華埠(萬安街(Vine St)1001號)的費城華埠發展會的免費的無需預約的COVID-19疫苗接種站點接受第一劑疫苗。

一些不能接種疫苗的人可免於此要求:

- 五歲零三個月以下的兒童

- 有執業醫師簽名的醫療豁免的人

- 有宗教豁免權的人,他們以書面形式證明他們有真誠的宗教信仰而不能接種疫苗

任何被豁免的人在進入可容納1,000人或更多人的場所時,都必須在24小時內出示COVID-19陰性測試證明。此要求不適用於無法輕鬆進行 COVID-19 檢測的兩歲以下兒童。 。

這項疫苗規定適用於以下場所:

- 室內餐廳場所

- 較大空間內的咖啡館(例如博物館咖啡館)

- 酒吧

- 提供食物或飲料供現場消費的體育場館

- 電影院

- 保齡球館

- 其他提供食品或飲料供現場消費的娛樂場所

- 會議(如果提供食物)

- 食堂/宴會廳

- 允許在場內飲食的賭場

- 美食廣場的座位區應該被封鎖,並在進入座位區時有專人檢查疫苗狀況

此疫苗規定不適用於以下地方:

- K-12 和早期托兒機構

- 醫院

- 集中護理設施或其他住宅或醫療保健設施

- 室外餐廳

- 雜貨店/超市/便利店,但這些場所的非銷售區的就餐區除外

- 費城國際機場,但傳統的有座位的餐廳或有座位的酒吧風格的地點除外

- 救濟所或其他為弱勢群體服務的場所(例如; Hub of Hope)

這項規定不包括短時間或臨時目的(例如,不到 15 分鐘、拿起食物、使用浴室)進入室內場所的戴口罩的人員

對於不遵守此項疫苗規定或室內需帶口罩規定的食品企業可以致電 311 報告。

EMPLOYER INFORMATION

For Employees: Unemployment Benefits Due to Coronavirus

Do you have employees who were laid off or work less hours due to the coronavirus? PCDC is working to help families and individuals apply for unemployment benefits.

What you will need:

– SSN- Home and mailing address

– Telephone number

– Valid email

– Employer’s name, address, and phone number

– First and last day worked with employer

– Reason for leaving

– Pension or severance package information (if applicable)

**Additional information may be needed

Call PCDC at 215-922-6156. Monday – Friday 9:30AM – 6PM.

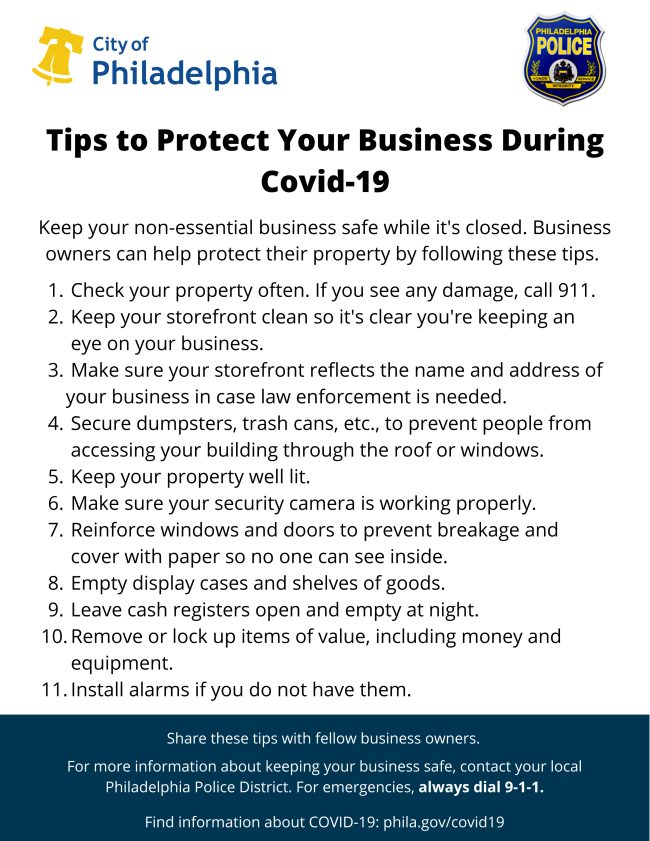

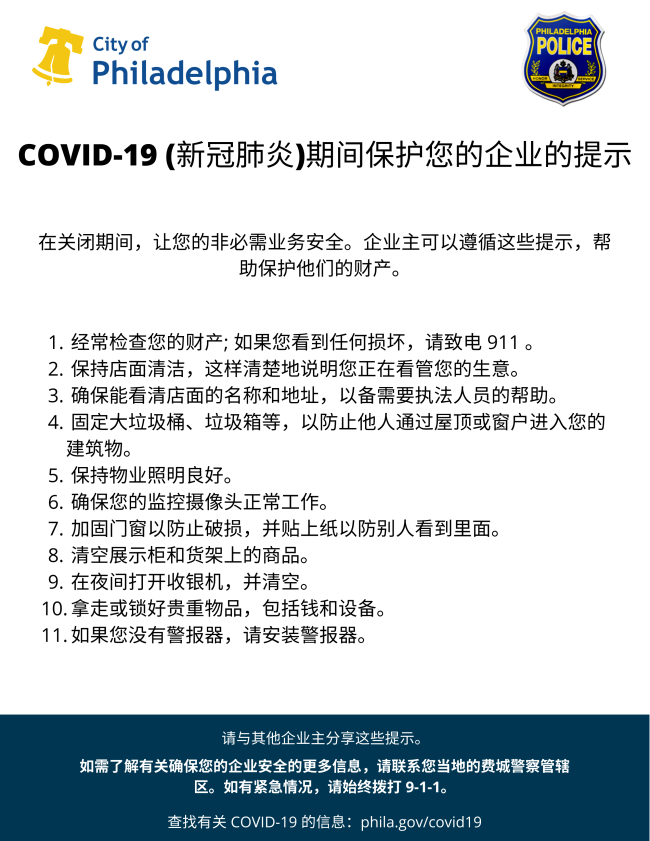

SAFETY & SECURITY

Protect Our Neighborhood: Register Your Security Camera with the Philadelphia Police Department

SafeCam is one of the Philadelphia Police Department’s contemporary crime prevention and investigation tools that demonstrates the effectiveness of partnerships between police and the community.

Registering your camera not only helps deter crime, but assists the Department in its overall crime prevention strategy in your neighborhood.

Protect yourself, your family and your community by registering with SafeCam.

Become a part of the Philadelphia Police Department SafeCam network!

SafeCam Program Registration

Social Distancing for Essential Businesses During COVID-19 Coronavirus

The City of Philadelphia strongly recommends the following precautions to protect yourself, your employees, your patrons, and the broader community:

In accordance with the Philadelphia Health Department, to make sure that your business continues to provides goods and services, while also keeping your customers and clients safe, we highly recommend using the following guidelines for your stores:

- For pick up and delivery, having customers and delivery men wait in a designated area that gives each individual at least 6 feet of space to the next person.

- Consider limiting the number of people in the store at one time. This includes any atrium and other areas that would have people waiting in tight spaces. Consider implementing the “nightclub model” of setting a maximum capacity and assigning staff to manage the number of people entering. Once maximum capacity has been reached, staff can allow more customers inside as others leave to maintain the maximum capacity and help customers shop safely. It is recommended to also encourage social distancing if lines form.

- Social distancing recommendations must be met (i.e., limit contact of people within 6 feet from each other). Consider: floor markings and visual cues to help customers keep a six-foot distance, only operating every other register or check-out lane, ensuring work space between workers is at least 6 feet.

- Whenever possible, encourage customers to call ahead or place orders online so that staff can select and pack up groceries for customers to pick up or have delivered. Ensure customers who use SNAP have access to the same delivery services and pick up options whenever possible.

- Schedule handwashing breaks every 30-60 minutes. Employees should wash hands with soap and water for at least 20 seconds. Assign a relief person to step in for cashiers so they can wash their hands with soap for a full 20 seconds. Provide hand lotion so workers’ hands don’t crack.

Full list of social distancing and safe hygiene practices for businesses: Social Distancing Precautions

Personal Protective Equipment (PPE):List of Business Suppliers

Businesses that are looking to purchase PPE to keep their business safe for staff and customers, the Pennsylvania Department of Community and Economic Development has compiled a directory of PPE and supplies vendors, “Pennsylvania COVID-19 PPE & Supplies Business-2-Business (B2B) Interchange Directory”.

The directory includes vendors that sell N95 Masks, Fabric & Other Masks, Surgical Masks, Thermometers, and Hand Sanitizer.

About the Interchange Directory:

Company and product information provided in this directory were gathered in good faith as a means of connecting Pennsylvania businesses and organizations that are seeking various PPE and other related items to combat the COVID-19 crisis. The information made available is from those entities who voluntarily contacted the commonwealth through the Manufacturing Call to Action Portal or the Pennsylvania Critical Medical Supplies Procurement Portal.

The immediate goal of this B2B Interchange Directory is simple: to provide an opportunity for companies and other entities in need of PPE and other critical items to make a B2B connection as they may choose with manufacturers and suppliers of COVID-19 related items.

Click to here to see Directory

開工企業的員工和客戶必須戴口罩及其他新規定

2020年4月15日,聯邦州宣布對與客戶有面對面交流的企業實施了新規則,旨在保護公眾放置COVID-19的感染。

從2020年4月19日(星期日)晚上8點開始,每月州所有與客戶有面對面交流的開工的企業將必須遵守當地州衛生部在本通知中列出的新規定。這些新規定包括:

- 強制要求員工在工作場所戴口罩

- 要求所有客戶在場所內戴口罩,並拒絕未戴口罩的個人進入,除非企業在提供藥品,醫療用品或食物,在這種情況下企業必須提供替代的方式來提取或運送此類物品

- 鼓勵使用在線訂購,為客戶提供取貨和送貨服務

- 提供足夠的空間供員工休息和進餐,同時保持6英尺的社交距離,安排座位,使員工在進餐和休息時避免與他人面對面而坐;

- 在可行的情況下,企業應僅通過預約與公眾進行業務往來,在不可行的情況下,企業必須將場所內部的人員控制在正常人數(證書上規定的人數)的百分之五十以下。為了減少業務場所的擁擠,必須在結帳和櫃檯線處保持6英尺的社交距離,並且必須在每個點上放置標牌,以強制客戶和員工保持必須的距離。

因疫情關閉的非必要商戶暫時免交使用和占用稅

———————————– 此消息更新于4/22/2020 ———————————–

因控制疫情的安全措施而被下令於2020年3月17日開始關閉的商戶,在禁令期間,不需繳納使用和占用稅(U&O)。

但是,無論是否選擇經營,被視為必要的商戶,即 Essential Businesses(例如食品服務)都要照常繳納使用和占用稅。

如欲瞭解詳情,請訪問市政府的使用和占用稅指南:https://www.phila.gov/media/20200409153648/Use-and-Occupancy-UO-Tax-covid-guidance-040920.pdf

強制關閉某些企業-受影響的企業類型,豁免請求等

2020年3月19日,州長湯姆·沃爾夫(Tom Wolf)下令賓夕法尼亞州所有非維持生命的企業在晚上8點之前關閉其營業地點,以減慢COVID-19的傳播速度。從3月21日星期六凌晨12:01開始,對沒有遵守關閉令的商業實行強制措施。

強制關閉-豁免請求尋求豁免和豁免關閉令的企業可以聯繫RA-dcexemption@pa.gov尋求幫助。

企業類型清單:此处

州長的公告:此处

雇主須知

致雇员:由於COVID-19冠狀病毒而造成的失業福利

您是否因冠狀病毒而被解僱或工時減少?PCDC正在努力幫助家庭和個人申請失業救濟。

請準備以下材料:

-社安號(SSN)

-家庭住址和郵寄地址

– 電話號碼-有效的電子郵件-雇主的姓名,地址和電話號碼-受僱時間(第一天到最後一天)

– 離開的原因-退休金或遣散費信息(如果適用)

**可能需要其他信息

打電話 Call:215-922-6156週一至週五, 早上9點半至下午6點

安全

为了保护我们的社区,请在费城警察局注册安全摄像机

SafeCam是费城警察局预防犯罪和调查的一个工具,展示了警察与社区之间合作伙伴关系的有效性。

为您的相机注册不仅可以帮助遏制犯罪,而且可以帮助警察局制定总体预防犯罪策略。

通过注册SafeCam保护自己,家人和社区。

成为费城警察局SafeCam网络的一部分!

SafeCam註冊程序

為防止COVID-19冠狀病毒的擴散,應保持一定的安全距離

根據費城衛生局,為確保您的業務不中斷,同時又確保客戶的安全,我們強烈建議大家做以下事情:

- 提貨和送貨:請客戶和送貨人員在指定區域等候,該區域內人和人之間至少保持6英尺的距離。

- 考慮限制每次進入商店的人數。這包括店內所有的空間。考慮實施“夜總會模式”,即設置最大容量並分配人員來管理進入的人數。一旦達到最大容量,員工就得等有人離開以後再放人進去,以保持顧客的安全。如果排隊,也建議保持足夠的距離。

- 建議大家嚴格保持社交距離(即,將彼此間的距離限制在6英尺之內)。請考慮:用地板標記和視覺提示的方法幫助客戶保持六英尺的距離,收銀機或結賬通道之間也應保持至少6英尺的距離。

- 盡可能鼓勵客戶提前電話訂購或在線訂購,以便員工可以有時間為客戶備貨或送貨。確保使用SNAP的客戶享有同樣的服務。

- 安排員工每30-60分鐘洗一次手。員工應使用肥皂和水至少洗20秒鐘。指派一名人員暫替收銀員,以便他們有時間洗手。提供洗手液,以確保工人的手不會破裂。

企業所要求的安全距離和衛生實施的完整列表:安全距離的注意事項

個人防護裝備(PPE):供應商清單

希望購買個人防護裝備以確保員工和客戶安全的企業:賓夕法尼亞州社區和經濟發展部已編制了個人防護裝備和用品供應商目錄,“賓夕法尼亞州COVID-19個人防護裝備和用品B2B交換目錄”。

該目錄包括銷售N95口罩,織物和其他口罩,手術口罩,溫度計和洗手液的供應商。

關於交換目錄:

本目錄中提供的公司和產品信息為尋求各種個人防護裝備和其他相關物品以應對COVID-19危機的賓夕法尼亞州企業和組織提供了方便。公司和產品信息來自the Manufacturing Call to Action Portal或the Pennsylvania Critical Medical Supplies Procurement Portal的門戶網站。

B2B交換目錄的近期目標很簡單:為需要PPE和其他關鍵項目的公司和其他實體提供機會,使其可以選擇與COVID-19相關項目的製造商和供應商進行B2B的連接。

單擊此處查看賓夕法尼亞州COVID-19個人防護設備和用品B2B交換目錄