- About

- Programs & Services

- Resources and Information

- Chinatown Community Center

- 新聞

- 聯絡我們

- Career

- DONATE

- EXPO 2024

- 中文

- About

- Programs & Services

- Resources and Information

- Chinatown Community Center

- 新聞

- 聯絡我們

- Career

- DONATE

- EXPO 2024

- 中文

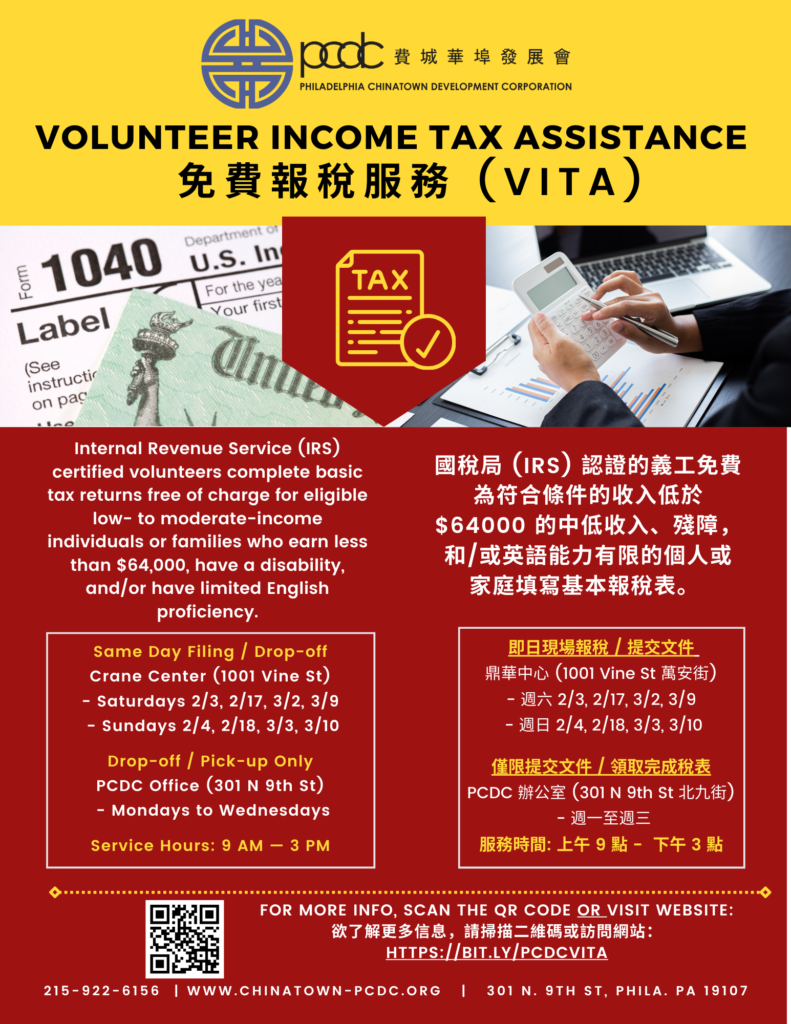

The VITA program has operated for over 50 years managed by the Internal Revenue Service (IRS). PCDC is one of the VITA sites that offers free tax help to people who need assistance in preparing their tax returns.

You may be eligible for VITA services if you are one of the following:

To prepare for the season, gather the following documents:

If available or applicable:

Way of service: (A) In-Person or (B) Virtual

(A) In-Person

Saturdays (9 AM — 12 PM; 1 PM – 3 PM): 2/3, 2/17, 3/2, 3/9

Sundays (9 AM — 12 PM; 1 PM – 3 PM): 2/4, 2/18, 3/3, 3/10

Mondays to Wednesdays: 9AM — 12 PM; 1 PM – 3 PM

(B) Virtual

Process

Any questions, please call PCDC hotline – 215-922-6156

免費報稅服務 (VITA)計劃由美國國稅局 (IRS) 管理已運行了 50 多年。PCDC 是 VITA站點之一,為需要協助準備報稅表的人提供免費稅務協助。

或者如果您屬於以下情況之一,則可能有資格獲得 VITA 服務:

為了報稅季作準備,請收集以下文件:

如果有以下文件的話,請一同帶來

服務方式:(A) 面對面 或 (B) 遠程 :

(A) 面對面:

週六 (上午 9 點至中午 12 點;下午 1 點 – 3 點): 2/3, 2/17, 3/2, 3/9

週日 (上午 9 點至中午 12 點;下午 1 點 – 3 點): 2/4, 2/18, 3/3, 3/10

週一至週三: 上午 9 點至中午 12 點;下午 1 點 – 3 點

(B) 遠程:

流程

如有任何問題,請致電 PCDC 熱線 – 215-922-6156。

© 2024 Philadelphia Chinatown Development Corporation. Built using WordPress and the Mesmerize Theme